If your property needs to stand vacant for a while, you probably already have a long list of things to do, like securing your property against fire, vandalism, theft, and squatting. There may also be bills to pay, like monitoring, maintenance, and vacant property business rates. (Of course, if you’ve arranged property guardians for the vacant period, you can rest easy on both of these counts!)

Understandably, insurance may be the last thing on your mind if you’re in the process of vacating a property, and that can be fine. If your building is only empty for a couple of weeks, you probably don’t need to start digging out your insurance premium to read the fine print. However, if your property is vacant for a month or more, that’s when you need to double-check what cover you will have in the event of a burglary, fire, or other damage.

How Long Can I Leave My Property Vacant?

Whether your building is residential or commercial, most insurers will cover your empty property for one to two months without raising your premium or introducing new conditions. The logic behind this timeframe is that you’re covered if you need to vacate the property for a while, for example, to renovate or find new tenants, but not if the property is vacant in a more permanent way. So, for example, if you have a pipe burst and you need to conduct repairs before you can use the building for its usual purpose, your insurance will usually remain in place during a reasonably short renovation period. But if that period extends beyond 30-60 days (depending on your insurer) you may need to re-insure under a different, and more expensive, type of cover called vacant property insurance.

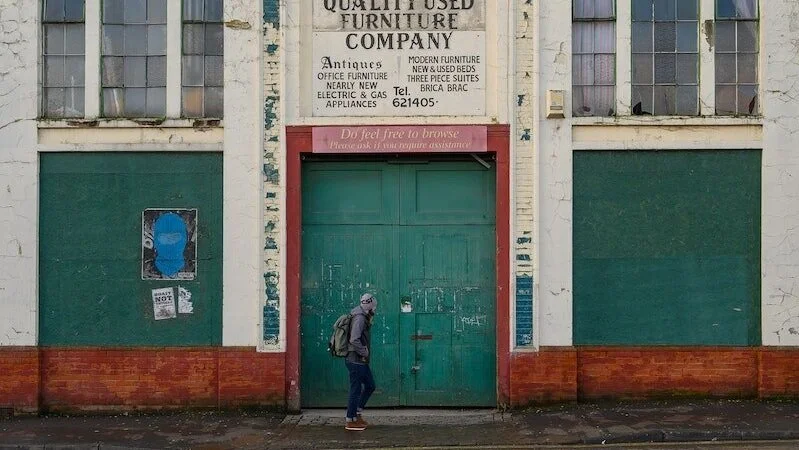

Photo by Andy Falconer on Unsplash

Do I Have to Notify My Insurer?

Yes. It’s essential to consider the ins and outs of insurance prior to vacating your property so as not to get caught out. The onus is on you to let your insurer know that your property is vacant, and adhere to the timeline in your contract. If you fail to notify your insurer that your property will be vacant for an extended period, and you’re unlucky enough to have to make a claim during this time, you may find that your insurance cover is not valid.

Why is Vacant Property Insurance So Expensive?

While it may seem frustrating that your building costs more to insure when it’s vacant than when you’re actually using it, there is a reason for this. When it comes to insurance, vacant properties are higher-risk assets than occupied properties. This is because they are more likely to be targeted by vandals, thieves, and squatters, who seek outbuildings that are unguarded.

Empty buildings come with a higher likelihood of accidental damage, too. For example, a relatively minor maintenance issue is easy and inexpensive to fix if the building’s inhabitants spot it quickly and take action, but if nobody is home, that issue can escalate and cause serious damage. For example, water in a crawl space can cause rising dampness and eventual structural damage. And on the more extreme end, an electrical fault can start a fire. So you can see where your insurer is coming from when they tell you that your insurance premium needs to be revised to account for the added risks posed to your vacant property.

What Are My Other Options?

Of course, understanding the added risks doesn’t take the sting out of the hiked insurance premium. When your property is vacant, the last thing you want is to spend more money on the building than you did when it was occupied. Added to business rates, security fees, as well as maintenance costs, vacant property insurance can make vacating your property start to seem untenable. If you’re looking down the barrel of these types of costs for your empty property, you might start to re-think leaving your property empty at all. And with Blue Door Property Guardians, you don’t have to!

We install responsible, properly vetted guardians to protect your property with their 24/7 presence. Since your building is occupied, you can forget vacant property insurance and all the other costs and worries that come with leaving your property vacant. The best part? Our property guardianship scheme costs you nothing. You do your bit by providing the property. Check out our services for property owners to find out more about how we do ours.

Read More:

Photo by Mathias Lövström on Unsplash